Roth ira phase out calculator

It is important to. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

Ira Calculator See What You Ll Have Saved Dqydj

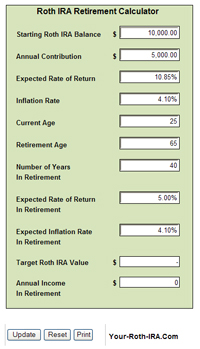

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

. So to calculate your reduced Roth IRA contribution limit you first calculate the percentage of the way you are through the 10000 phaseout range and then multiply that. So thinking youre not ready to retire following year you desire development as well as focused investments for your Roth IRA. It is mainly intended for use by US.

Creating a Roth IRA can make a big difference in your retirement savings. This calculator assumes that you make your contribution at the beginning of each year. For such persons the Roth IRA phase out takes effect if you earn between 169001 and 179000.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. Which is much higher than the.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. This is so because the law. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3.

This calculator assumes that you make your contribution at the beginning of each year. The calculator will estimate the monthly payout from your Roth IRA in retirement. You and your spouse are 45 years old and have a combined income of 174000.

Roth IRA Phase Out Calculator. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. This calculator assumes that you make your contribution at the beginning of each year.

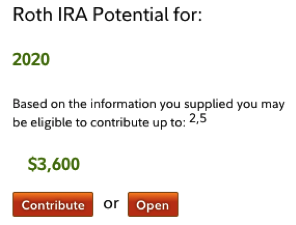

We are here to help. During the 2022 tax year your Roth IRA contribution is phased out based on MAGI. Roth IRA contribution limit calculator is devised to help you estimate the amount of contribution possible in your case for the tax year 2020 and 2019.

If you would like help or advice choosing investments please call us at 800-842-2252. For the purposes of this. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. To put it simply you wish to. This calculator assumes that you make your contribution at the beginning of each year.

It is important to. Full contribution if MAGI is less than 129000 single or 204000 joint Partial contribution if. It is important to.

Married filing jointly or head of household. 9 rows Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. The amount you will contribute to your Roth IRA each year.

Certain products and services may not be available to all entities or persons. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

You can adjust that contribution.

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculator Roth Ira Contribution

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculators

Roth Ira Phase Out Calculator 2019 Youtube

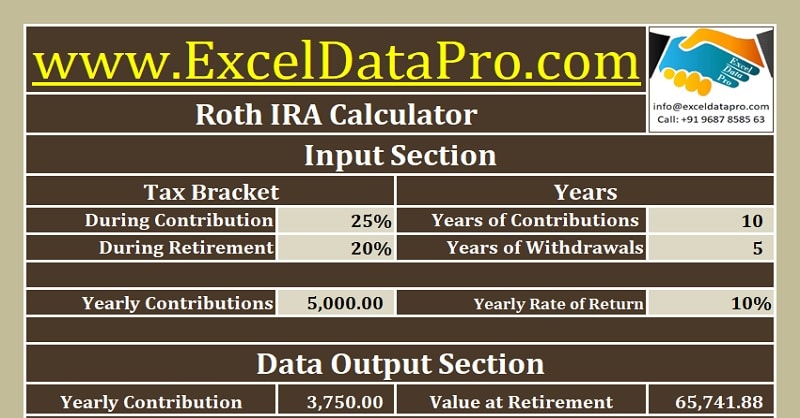

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Best Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator